Steven Molnar

International Property Educator and Strategist

Cameron Fisher

Director Changing Places Real Estate

Konrad Bobilak

Director of Investors Prime Real Estate

Stephen McClatchie

Director Loans Australia

Joel Hewish

Director and CEO of United Global Capital

Anna Pitchouguina

Lawyer at Batten Sacks Lawyers

Colin Adno

Partner at Batten Sacks Lawyers

Pasha Mehr

Principal Solicitor of CRS

Brendan Frost

Director of Landmark Inspections

Bradley Beer

CEO BMT Tax Depreciation

If you are looking to build a Multi-Million Dollar Investment Property Portfolio passively, with no stress, that has the potential to eventually replace your job income, and give you the opportunity to change your life forever and live it on your terms… Then register yourself to this upcoming live 4 day Finance and Real Estate Workshop called - The Property Portfolio Accelerator Summit!

You may have already said these words…

And no doubt, you’d have over-heard someone else say them…

“If ONLY I had bought property back then…”

Let’s face it, that old story’s been told as much as the “fish-that-got-away” yarn, right?

Ooh... what we’d give for a crystal ball… so we could take a sneak glimpse into the future to see what the property market will do. Or better still, a time machine so we could wind the clock back and invest in the previous property boom! Keep dreaming!

No such luck – BUT, would you like the next best solution??

And, who can take most of the guess work and hard yakka out of it for you?

If that sounds good then keep reading…

If you’re open to the idea of becoming a successful property investor and would like help in making the right choices...

If you would like to join the others who are taking advantage of what’s being seen as the greatest property opportunity in the last 10 years...

If you are cautious about who to trust – who to listen to - what moves to make – but deep down, you have a strong desire to improve your current financial situation once and for all...

Big call? Maybe. But if you knew what I knew, then believe it or not, you’d have the same confidence (and even excitement) about the times we’re in right now.

Everywhere you look these days you’re faced with negative, fear based and sensationalised headlines, claiming the “sky is falling”, right? I hear it all the time. Most people are too paralysed by fear to make a move.

Do you remember the countless failed property crash predictions and media stories that were perpetuated throughout 2018 and 2019 by so called academic ‘Experts’ and unqualified journalists?

Well, permit me to remind you…you may recall the famous Armageddon, Doom and Gloom story run by 60 minutes back on September 16, 2018, entitled ‘Brick and Slaughter’? Prophesying the ‘inevitable’ Australian Property Market Crash, by 40%?

“Bricks and Slaughter”, the 60 Minutes report by journalist Tom Steinfort focused on a “nightmare” scenario outlined by Digital Finance Analytics principal Martin North. It predicted;

“…two-fifths of your home’s worth [would be] wiped out in just 12 months – 40 per cent in a year”…and that was just the beginning…

Now remember, that was back in 2018…it’s now 2022 and for the record we have had the biggest property bull run since 1989.

In fact;

The Australian Residential property market returned an unbelievable 22.4% for the year-on-year in January 2022!

Making their highest annual rate of growth since June 1989, according to CoreLogic.

But let’s remember that old saying that 'the Media will NEVER let the facts get in the way of a good story’.

And the best stories are always negative!

As they say…. BAD NEWS SELLS!

Here are just a few headlines and failed predictions of the inevitable Doom-and-Gloom Armageddon!

No wonder the Australian public, to a large extent, are completely confused, disillusioned and end up sitting on the sidelines…

And I don’t blame them, as it’s very had to work out WHO TO LISTEN TO and WHO TO TRUST, especially when most, so called ‘Academic Experts’, Journalists and even the Banks, keep warning us of the inevitability of the Property Bubble Bursting and the Australian Property Market Crashing!

No wonder the average punter is confused and paralysed! Look, if that’s you, then let me put you at ease...

It seems that the feeling most people get when setting out to buy investment real estate is of disorientation; they feel lost, overwhelmed, apprehensive and scared about throwing their life savings into a large purchase that they have no real idea about (as to whether it is good or bad).

Here are some typical mental “hurdles” that stop people from investing in investment property...

These mental “hurdles” are real, and if not addressed will indeed stop you from building the wealth that you and your family deserve.

Now, here is the scary and eye-opening fact; during all the scaremongering, doom-and-gloom failed predictions, guess what actually happened?

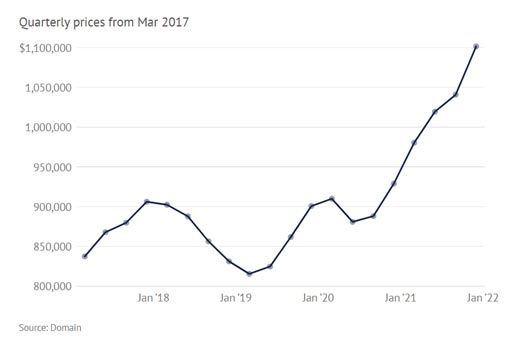

But it gets worse, much, much worse!... You see, during the last 3 years, when the largely uninformed media was prophesying that the bottom would fall out from the entire Australian Property Market, the opposite occurred! (how dare-it?)

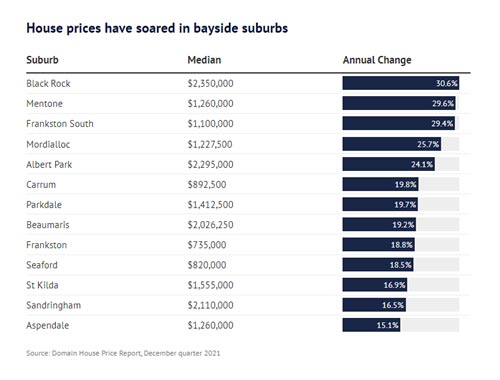

Interestingly enough, during the supposed Blood-Bath Armageddon, Melbourne’s bayside suburbs boomed!

The saddest part of all of this is that every-day hard-working Australians are being robbed from achieving these extraordinary results, as they end up listening to the scaremongering media and sitting on the sidelines, not taking part in the Australian Residential Property Market, which has been experiencing the biggest single property boom in the last 30 years!

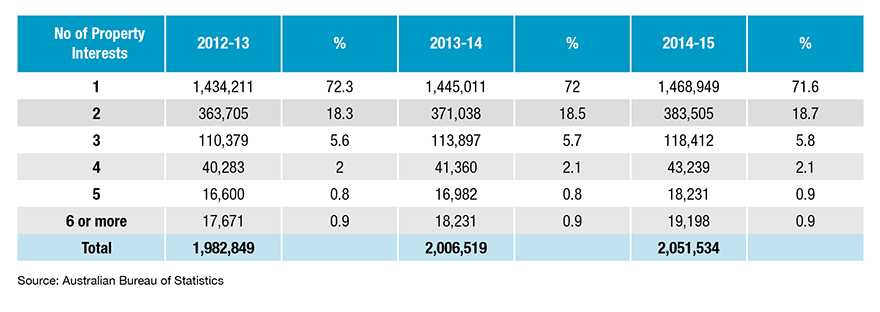

Here is some interesting data to back this up;

It seems crazy? Right?

I personally believe that one of the most important missing ingredients that separates the 1 per cent of property investors from the rest, apart from the ‘fear factor’ is knowing who to listen to, who to trust and the ability to objectively discern between relevant and irrelevant information.

That is the exact reason why you need to attend the 4 Day Property Portfolio Accelerator Summit 2022.

In fact, you’re about to discover a Proven Step-By-Step Buy and Hold Real-Estate Investing System… that is easy to follow and makes so much sense that I promise you that by the end of this 4-day summit you’ll be wondering why nobody has told you about it before.

Once you learn this system of investing, you’ll be mad at everyone around you who has been putting doubts into your mind about the possibility of you owning a substantial residential property portfolio. I know. Like you, I have been there myself many, many times over the last twenty-five years!

If you’ve ever felt ‘overwhelmed‘ or ‘stressed out’ with the seemingly insurmountable task of living your life…just getting by day-to-day without any hope of stopping work before you’re completely stuffed and old…with no energy or money left over to enjoy a happy, stress-free, successful life; to travel to faraway places, to give to your favourite charity whenever you like or simply have the time and financial freedom to do whatever you darn well like… then attending the 4-Day Property Portfolio Summit is just for you!

Not only that, by pleading and twisting some arms, I managed to engage the best of Australia’s Accountants, Solicitors, Financial Planners, Property Managers and Quantity Surveyors to speak at this amazing live event, and share their industry knowledge and secrets that literally took them a lifetime to acquire…and believe me, these guys are literally the best in the industry!

One thing that I must stress is that this is NOT a get-rich-quick scheme, and I guarantee that you will NOT become a millionaire overnight by following this system. I am not going to insult your intelligence or make unrealistic claims.

This is definitely a Get-Rich-Very-Slowly over a 5 to 10-year time frame!

So, if you want to Get-Rich-Quickly, you might as well stop reading right now and forget attending immediately!

As this event is definitely not for you… you might want to try investing in NFT’s, IPO’s, Cryptocurrency, Selling vitamins on AMAZON, or Exercise Equipment on eBay, or whatever the latest flavour of the month thing is right now…And good luck with those!

By attending the 4 Day Property Portfolio Accelerator Summit you will learn how to build, sructure and automate, a multi-million dollar property portfolio in your spare time, that will have the potential to eventually enable you to replace your job income and to follow your true purpose or destiny!

Not only that, you will learn how, with laser-like precision, to identify the very best long-term performing suburbs in Melbourne, and different types of specific properties within these suburbs that outperform the majority of the market, in terms of Capital Appreciation, medium to long term.

You will also learn how to do this in Australia’s major capital cities, and how to best structure your investment property in the most tax-effective way, passively, whilst optimising your loan structures in such a way that your home loan is paid off in record time!

So, what’s the ‘System’ that I am referring to here, you ask?

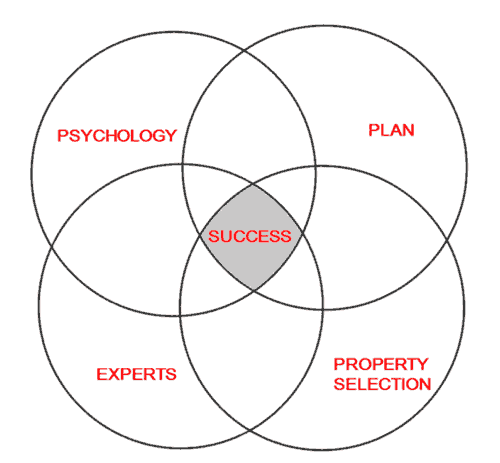

Well, the System is broken down into 4 parts, or 4 ingredients if you like; 1. Cultivating the right investor psychology, 2. Having a system, 3. Access to a network of the right professionals, 4. Buying the right type of investment properties in ‘Key’ capital growth areas…

But I am really getting ahead of myself here, more on this later…

The sad reality is, that whilst we live in arguably the best country in the world, with an extremely resilient real estate market, very few Australians manage to put all the puzzle pieces together to make any substantial wealth though real estate.

But don’t despair, the good news is…

Sure, if you look hard enough, you can find stories about people who made bad decisions and lost money investing in real estate. But on the flip side...

You don’t have to look very hard to find plenty of people who have obviously made significant profits from real estate. Just go to any newsagent and pick a copy of any Australian Property Investment Magazine off the shelf…

Having said that, the majority of successful property investors that I know keep their successes closely guarded... either because they don’t want to “big note” themselves, or they do not want to give away their secrets and create their own competition.

As a result, most new investors never get into the real estate investment market because of their fear of not knowing enough, or not knowing where to turn to get the right information.

Until now that is…

All this could change by simply immersing yourself in 4 days of some of the best unbiased education in Australian property investing delivered by some of the foremost thinkers and industry experts, all under the same roof, to what is called The 4 Day Property Portfolio Accelerator Summit 2022!

But first... If you truly understand the gravity of this next statement, then you will be streets ahead of the pack. Take note:

“Since almost the beginning of time - people look at the current value of homes and more often than not - compare them to six or twelve months prior and think, “Ooohh, it seems too dear now, maybe now is not the right time to buy, I will wait a while until the market drops.”

If only people understood that, “What it is – is what it is!” If only they would take the emotion and fear away and accept that “The current price IS WHAT IT IS!”, their approach to buying property would be vastly different.

History has shown that property in ‘key’ areas has, and will, always go up over long term. Some periods faster than others of course – but the worst thing you could do is sit back, do nothing and wait to see it happen!

Property in key areas will always go up, despite all the negative fear based rubbish we’ve been hearing from the media that the ‘property bubble is bursting sometime in the near future, and that all greedy property investors in Australia will be very, very sorry, so it’s best to stay indoors, turn off all the lights, and stick your head under the doona’!

Funny how the ones making these predictions virtually never have any property behind them…

Don’t get me wrong... I’m not being one of those over-the-top “glass half full” guys who is totally denying our economy is facing challenges in the future, such as increasing unemployment, declining retail sectors, and the slowdown of the mining sectors. Not at all...

In fact, my message is timely and URGENT due to the fact that...we are about to enter one of the biggest property bull runs in Melbourne and Sydney of our generation!

Now, some of you will think… Can this actually be true?

Or, what's the catch? Right?

Well, there is no catch…

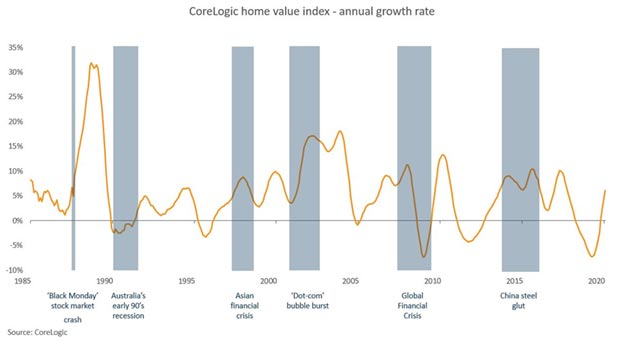

Remember that history tells us that every Australian economic correction, was followed by an extended property boom!

From the 1987 stock market crash, to the early 1990’s recession and economic stagnation, to the late 1990’s Asian Currency Crisis, the early 2000’s dot.com bubble burst, the 2008 Global Financial Crisis, to the 2015 China Steel Glut, and eventually the 2019 Covid-19 Pandemic, all were followed by a strong economic recovery and an underlying Property Market Boom!

And here is why it is extremely important for you to get educated about the right way to build, structure and automate your property portfolio as soon as possible, before it becomes completely unaffordable to buy any decent investment properties…

You see many in-the-know property investors have already made an absolute killing in the property game in the last 12 months.

In-fact;

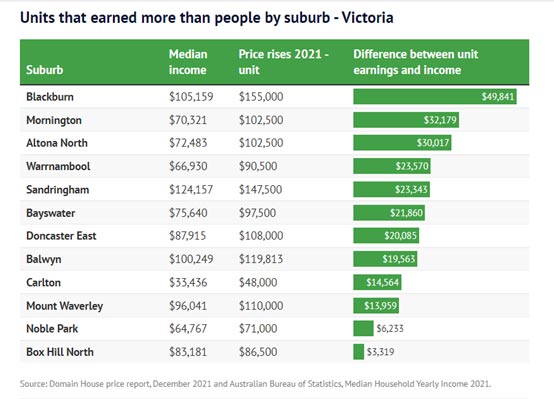

The latest data showed that some 291 of Victoria’s 428 suburbs had house price rises that outstripped local median incomes, while wages rose by just 2.2 per cent last year.

For those lucky enough to live in the above mentioned suburbs, or for those who had the foresight to invest there it was literally the equivalent of ‘Winning Lotto!’.

Once again, allow me to restate this point. Owners in these suburbs made less income in their job, compared to the capital appreciation of their house! Which means that they were literally making money while they slept!

I don’t know about you, but the idea of making money passively while I sleep is very appealing to me…

So, let me ask you this question;

If the answer is a resounding NOW!, then do yourself a favour and secure your ticket to the upcoming live 4-day life changing event now!

You will learn advanced property investing strategies and learn specific real estate finance and due diligence methodology that will give you the confidence and skills to start building your property portfolio as soon as you leave the event.

You will gain new insights on how to understand property cycles, state-by-state, and exactly how to hone in, with laser-like precision, on Melbourne’s Hot Spots in 2022 and beyond.

How to research the property market and understand the Top 10 Fundamental Assessment Criteria and drivers that create pressure on capital appreciation of suburbs, like a professional property investor.

How to identify with accuracy where the HOT SPOTS will be in Melbourne in 2022 and beyond, including a special session on Regional Hotspots.

How to create a winning team of experts and professionals, such as mortgage strategists, property Accountants, Property Lawyers, Financial Planners, etc who will propel your investing endeavours to the next level.

How to identify the exact type of properties, i.e. house and land, townhouses or apartments to target in Melbourne’s highest capital growth areas, and which suburbs and areas you will need to avoid investing in and why.

You will learn how to potentially slash years and tens of thousands of dollars off your current 30-year Principal and Interest home loan, this single ‘Key Distinction’ is literally enough to justify attending the entire 4 day live event!

You will learn how to best structure your first investment property acquisition, wherein you maximise your tax deductions, maximise asset protection, flexibility, and simultaneously tap into the power of leverage.

You will learn how to beat the banks at their own game by understanding the exact formulas the banks use to work out how much money you can borrow, (Debt Servicing Ratio (DSR)).

You will learn 18 Powerful Ways to ‘Super-Charge’ your borrowing capacity that will enable you to buy more property than you ever thought possible.

You will learn the ‘19 Crucial Questions’ to ask in order to choose the best Mortgage Broker in the industry.

You will learn the ‘12 Most Common and Deadly Property Finance Mistakes and How You Can Avoid Them’.

You will understand the importance of balancing your property portfolio between Cash-Flow Positive properties and Negatively-Geared growth properties.

You will learn how to get 1% plus discounts off your standard variable loan rate, save thousands of dollars in unnecessary interest payments and wipe years off your loans…plus much, much more.

Did you know that whilst a small percentage of the Australian population has managed to increase their wealth through property investing, very few are actually maximising their returns, and fewer still have worked out how to optimise their financial structures best?

Whether or not you are aware of this, this is costing you money, and more importantly the opportunity cost of time, and missing out on the potential of paying off your (non-tax deductible ‘bad debt’) home loan sooner, as well as missing out on accumulating more investment properties (tax deductible ‘good debt’) in your property portfolio.

From my personal experience and observations working in the mortgage broking and banking industries, most property investors settle for under-performing property portfolios as well as unsuitable loan structures that are robbing them of thousands of dollars per year…

And that’s the reason why we have assembled some of Australia’s top property experts and forward thinkers in the Real Estate Investing arena… this was our number one objective!

You see, whilst there is a plethora of information out there on how to find the best performing suburbs and properties, and about market timing, etc., very few books and/or individuals are teaching the fundamentals behind how to best structure a large property portfolio, from purely a ‘finance’ perspective.

That’s why it’s so imperative for you to attend the ‘4 Day Property Portfolio Accelerator Summit 2022’ and re-set your belief systems about property investing, leverage and structuring large property portfolios, and experience that vital paradigm shift that is required for you to once and for all, master this realm.

You see, by attending this life-changing 4 day event you will learn the ‘secret recipe’ on how to correctly structure your finances with the objective of maximising leverage & tax efficiency, whilst focusing on buying more investment properties and simultaneously paying off your home loan in record time.

So, let me ask you something…

Would you like to know what this ‘secret recipe’ is that I am referring to here?

If your answer is a resounding ‘Yes!’, then keep on reading…

But here is the thing…

Perhaps the most important aspect of your investing journey is ‘to start’ investing. Too often, first-time investors become overwhelmed with due-diligence, or differing opinions, or suffer paralysis from analysis, and consequently delay the investment process indefinitely.

Building and structuring a multi-million-dollar property portfolio that will eventually free you from work is based on a specific process, much like a recipe for baking a cake.

When you want to bake a cake, you locate that special recipe you want to prepare. Then it’s a simple matter of sourcing the right quality ingredients, adding them in the correct sequence, and following the rest of the directions until you arrive at the finished product.

The key is, to make sure that you get quality ingredients, in the correct order, or your cake will not be a success.

Building wealth through property is basically the same.

The key is to conduct research, find out how other successful property investors have built and structured their property portfolios, who and what they have sourced, how they have made their money work for them, and for you to do the same.

Once you have found the winning recipe or plan that has worked for other successful investors, then it becomes a simple matter of repeating the process until you have built and structured your investment property portfolio correctly.

And although this process sounds simple, as you will find out by attending the ‘4 Day Property Portfolio Accelerator Summit 2022’ live event, it’s actually not easy to do, as there are very few successful property investors in Australia who have managed to build large property portfolios, and very few professionals who can help you get there.

So, the million-dollar question is …what’s the recipe?

Well, that’s exactly what this 4-day event is about, and, from a high-level perspective, here is the recipe, broken down into four essential elements or ingredients.

There are four critical components or ingredients, if you like, that make up the winning recipe for successfully building a large multi-million-dollar property portfolio that will enable you to achieve financial independence;

When all four components of this winning recipe are added together in the right sequence, using quality ingredients, and at the right time…magic happens!

But just like baking a cake, it’s very easy to get the quality of the ingredients wrong, or to mix them in the wrong order or to simply leave the cake in the oven too long and burn it!

Then, of course, there is the actual recipe itself, which outlines the exact method and order that the ingredients are mixed with each other. Following a recipe or a proven formula is the essential part of maximising your chance of succeeding as a successful property investor.

Let’s examine the first component of the formula, Investor Psychology, which is perhaps the most important component of the Property Investing Wealth Formula.

The term Investor Psychology will mean different things to different people, especially when it comes to the world of property investing, given that there are so many approaches and strategies that exist in this realm of investing.

For example, there are buy and hold investors buying growth properties, investors interested in cash flow positive properties, investors who renovate properties and manufacture capital growth, investors who secure properties via option contracts and on-sell them, and investors who buy property for the purpose of re-development, subdivisions, re-zoning…the list is endless.

Ultimately, there are some commonalities linking all these investors, and their approach to property investing, and it has more to do with what belief systems they adhere to and how they operate.

As Wallace D Wattles put it in his famous book ‘The Science of Getting Rich’, the rich get rich by;

“Doing things in a certain way” not by doing “certain things”.

~ Wallace D Wattles

In other words, it’s not what you do, it’s the way that you do it, and that’s what gets results.

That is, these individuals understand a few fundamental principles about successful investing. Primarily, they know that in order to become wealthy, they must be comfortable with acquiring debt. Specifically, they focus all their efforts on accumulating growth assets, using good debts, or tax-deductible debts, while avoiding taking on bad debts or consumer credit, which has no tax advantages to secure assets that devalue over time.

Furthermore, investors with the right Investor Psychology tend to use other people’s money or OPM.

For example, they use the maximum Loan to Value Ratio, say 95% and are comfortable paying Lenders Mortgage Insurance (LMI) as they know that the most crucial aspect of investing is in assessing the Return on Equity (ROE) not Return on Asset (ROA).

They also do not own any assets in their own name; that is, they use Trusts and Corporate Trustees to Control Assets rather than to Own Assets.

This is a huge distinction that is incongruent with what the average Australian is conditioned to believe about property acquisition.

You see Rich people simply Control Assets; they don’t necessarily own them! That is, they buy investment properties via trusts and corporate trustees, not individual names.

It’s the poor and middle class in Australia that has been conditioned to believe that they need to own everything in their own names and pay all their assets off!

This makes them literally a walking target when it comes to litigation!

Always remember, ‘Whatever gets grouped together, dies together!’…

Finally, investors with the right Investor Psychology invest in their own personal development and network with like-minded individuals, who support their investing endeavours.

They understand that the only risk in investing is them, not the market and that the market, whether it is the property market or stock market, is simply a vehicle that transfers wealth from the uneducated to the educated.

You have probably heard the old saying; ‘If you fail to plan, you plan to fail’, …

This is perhaps the most crucial ingredient in the recipe of successfully building a multi-million-dollar property portfolio and one that this often overlooked or entirely neglected by novice property investors. Your ability to develop an all-encompassing, tailored-made investment plan could quite literally mean the difference between succeeding and failing in the property game.

The process of correctly identifying and locking in your starting point, and then your ultimate investment objective or outcome destination ensures that you will stay on course is a key process that is extensively covered in this ‘4 Day Property Portfolio Accelerator Summit 2022’ live event.

It is extremely important that you develop an ability to clearly articulate and write down your property investing goals and be as specific as possible.

The more details you include in your plan and the more clarity you have about who and how to implement your plan, the more likely are to succeed. Generally speaking, there are three main ways to generate a passive income from your property portfolio.

The type of investment strategy will largely be determined by your level of risk profile, and time horizon for investment. Your risk profile will be largely determined by your age, or how close you are to 65 years of age, your level of financial literacy, the level of equity that you have available to invest into your property portfolio, and how much actual time you have available per week to invest in property.

The ‘4 Day Property Portfolio Accelerator Summit 2022’ live event explores these points in more detail and enables you to create an individual, all-encompassing investment plan, based on property acquisition, that is right for your specific set of circumstances.

Remember that ‘if you aim at nothing, you will hit it with great accuracy every single time!’

You see, behind every successful property investor or self-made millionaire, there is a team of experts that have been that person’s catalyst for success. Put simply, all the psychology, and specialized knowledge in the world will not translate to actual results.

Other specialists are needed to bring the Investor’s plan to fruition.

That is, one needs a solicitor to settle the property, a real estate agent to sell the property, a mortgage broker to submit the loan to the bank…and so on.

These specialists form the individual’s Mastermind Team of Industry Experts.

Most successful property investors are themselves not experts in every single field of property investing. Rather, they become generalists, relying on their Mastermind Team of Experts, and they leverage from their expertise and knowledge. Such a team may include, but is not limited to the following individuals:

The key to your success, which is the basis of this ‘4 Day Property Portfolio Accelerator Summit 2022’, is to develop your level of Specialized Knowledge to such an extent, that you can:

Prequalify and shortlist your key Mastermind Team of industry experts.

Coordinate them in a manner that will enable them to implement the necessary steps and actions that will eventually lead to your desired outcome.

The difficulty with accurately identifying and prequalifying the relevant experts which will ultimately form part of your Mastermind Team, lies with your level of Specialized Knowledge in that particular field, and your ability to ask the right questions in order to prequalify and shortlist them.

This is exactly why we have assembled the A-Team of Key Speakers who in their various professions have helped literally hundreds and even thousands of property investors successfully build, structure and automate their property portfolios.

By attending the ‘4 Day Property Portfolio Accelerator Summit 2022’ you will learn how to assemble your own Mastermind Team Of Industry Experts and Specialists that will propel your personal wealth to a whole new level!

Remember that your success, as a property investor, to a large extent, will be ONLY as good as your team!

Or put it another way, your cake will taste as good as the ‘quality’ of the ingredients that you source.

You probably may have heard an old saying; Land Appreciates and Buildings Depreciate, hence the money is always in land. Which brings me to one of the most important Key Drivers of Capital Growth to appreciate (and there are several of them!), which is that Not all Land is Created Equal.

That is, 100 square meters of Land in Richmond will always outperform 1,000 square meters of land in Melton. Always remember that 80 per cent of the growth is based on the location, and only 20 per cent of growth is based on the type of dwelling.

That is, in most cases, the location of the block of land, rather than size will determine the level of capital growth, as long as there are two factors simultaneously present.

There is the scarcity of land, and the most important one…

There is strong demand by people who have high disposable incomes, or the right demographics.

This combination of ‘scarcity of land’ in desirable, highly sought-after suburbs, combined with ‘high demand from people with high disposable incomes’, are the key factors behind capital growth of different suburbs in Melbourne.

By attending the ‘4 Day Property Portfolio Accelerator Summit 2022’ you will learn and explore in detail Australia’s top 20 highest capital growth suburbs over the past 10 years, as well as Australia’s 20 lowest capital growth suburbs, and the Key determining factors responsible for these outcomes.

This section of the 4-Day live event is a complete eye-opener for most property investors, as it enables you with accuracy to hone in on specific high capital growth suburbs and then specific types of properties within these suburbs that have the highest probability of outperforming the general market medium to long term; an essential part of any serious property investor’s knowledge base!

By attending the ‘4 Day Property Portfolio Accelerator Summit 202 you will learn the ‘secret sauce recipe’ that is the essential part of maximizing your chance of succeeding as a successful property investor, elevating you into the top 1% of property investors in Australia. Furthermore, you will also gain an insight into the type of Specialized Knowledge that you must acquire if your objective is to build and structure a multi-million dollar property portfolio in the most efficient way possible!

The Specialized Knowledge that I am referring to here includes the actual strategies which will allow you build a multi-million dollar property that will have the potential to fast-track you to financial independence and leave a true legacy for your future generations!

More specifically, the Specialized Knowledge refers to the Investor’s financial literacy and depth of knowledge of their chosen area of property investing.

You see whether it’s property options, property development, subdivisions, buy and hold, flipping or renovations, the ultimate success will lie in the investor’s grasp of the technical aspects of their strategy, together with their due-diligence and feasibility studies leading up to the deal.

By attending the ‘4 Day Property Portfolio Accelerator Summit 2022’, you will gain a rare insight into the Specialized knowledge base of sophisticated property investors, and learn how to conduct property due-diligence and cash-flow analysis. You will learn what kind of loan to choose for your first and subsequent property; interest only, principal and interest, fixed or variable, (full doc or low doc), which lenders to approach, who the purchasing entity of the asset is to be, and what kind of trust to use (discretionary, fixed unit, hybrid). You’ll also learn how to read depreciation schedules and how to calculate negative/positive gearing, just to name a few things.

Cameron is the Managing Director of Changing Places Real Estate and he has many qualifications that make him a top figure in the real estate market. These qualifications include: fully licensed real estate agent, qualified valuer, over 3,000 successful (and dynamic) auctions, adviser to leading Institutions, accountancy practices, and law firms.

Cameron’s services are used worldwide and his qualifications serve to demonstrate his extraordinary skill set. In this incredibly competitive industry, few can even compare to Cameron. His pioneering approach and upbeat personality make him a perfect choice for those leasing, selling or buying.

The Australian premier of “The Money Game” only offered more proof that Cameron Fisher is by far one of Australia’s elite entrepreneurs. He took on the challenge of going against Australia’s best and conquered it with surgical precision. Never was this more apparent than the challenge in which he was given $10,000 and told to turn it into as much money as he could within 55 hours. Using his impressive skill set, he turned the $10,000 into $65,466 within the 55 hours.

If you are a landlord, or buying or selling a property, then Cameron Fisher should be the only name you are thinking of.

Konrad has educated well over 120,000 Australians on how to successfully build and structure a multi-million dollar property portfolio from scratch that has the potential to replace your income and eventually free you from work!

When it comes to building a property portfolio the “RIGHT WAY” you will know you’re in the best hands. Konrad has extensive experience in Managed Funds, Risk Insurance, Real Estate Sales, Commercial Lending, Residential Lending, and Asset Finance, as well as being a Financier for one of the four major banks. In his variety of roles, working predominantly with high net worth individuals, Konrad has literally had a wealth of exposure to the unique mindset and financial structures of truly successful people and investors. It is his experience and insight that renders him a most astute investor himself, having personally built a multi-million dollar property portfolio in Melbourne and Queensland over the last decade; he truly practices what he preaches.

Konrad’s unique insights into ‘Wealth Psychology’ combined with a highly specialized knowledge of the Finance and the Real Estate Industry in Australia, have made him a sought after Real Estate and Finance ‘Key Note’ speaker and successful real estate investor. Having taught tens of thousands of people in Australia, New Zealand, and Fiji, Konrad has had the unique opportunity of sharing the stage with the likes of Sir Richard Branson, Tim Ferris, and Randi Zuckerberg in audiences of up to five thousand people. Konrad has also been a regular contributor of articles to some of Australia’s leading published real estate investing media.

As the Director of Loans Australia my vision is to create a company with the systems and structures designed to ensure that clients make the most of their finance situation to propel them forward. Having dealt with many investors and business owners with complex financing structures I understand the importance of setting up finance structures that can assist people to build a property portfolio or asset base. I specialise in showing people the most effective ways of mortgage structuring, strategic financing, management and mortgage selection. My passion is to educate people around finance so that the knowledge and know-how of clients is enhanced over time.

Outside of my business I enjoy property investing and have developed my own property portfolio over the last 15 years. I also enjoy spending time with my family, participating in sports such as tennis and cricket, and supporting my football team.

“But wait a minute, Konrad...”

Listen – don’t be a fool! Sorry to be harsh, but hear me out for a sec...

Throughout the past hundred years people have always had great reasons why not to invest in real estate. You name it...

World wars, great depressions, oil crises, high inflation, high interest rates, currency crises, the threat of terrorism, high unemployment, recessions and economic busts, introduction of GST, heck even the Y2K scare!

Here’s why... What’s interesting, is that approximately 70% of the Australian residential property sector has always been underpinned by owner occupiers. What does that mean?

Well, the other 30% of properties have been owned by investors. (Unlike the stock market which is made up of virtually 100% investors).

Let’s face it; people will always need “a roof over their heads”. It’s a basic human need.

Owner occupiers, (70% of the market) therefore do not necessarily rush out and sell the family home when economies are under pressure. (Again, unlike the stock market.)

So, there is always constant rental demand (approx. 30%) due to immigration, work transfers, families, students, singles, couples, marriage separation, commune living, government requirements, the holiday and leisure market etc.

Besides, did you know that some of the greatest fortunes in history were made out of recessions and flat markets (for the people smart enough to take the “right” advice)?

Here’s why we believe NOW is one of those times...

Lowest mortgage interest rates in recorded history, despite the recent RBA increase in the bank's official cash rate by 0.5% to 0.85%, Australia is still benefiting from the lowest variable rates in recent history.

Rising rents in ‘key suburbs’ in the major capital cities are about to skyrocket, on the back of COVID-19 supressed migration into the country! This has made real estate an attractive alternative to holding money in savings accounts and term deposits.

Future record high population growth though migration into the major capital cities will create more price pressure on properties in ‘Key’ growth suburbs and specific types of investment properties.

Stock Market volatility, and Crypto Market volatility, the Russian invasion of Ukraine, have all caused investors to seek the predictability and reliability of “bricks and mortar”; this is especially evident with major Self-Managed Superfunds buying real estate and further putting price pressure on stock.

With rising rents and lowering of interest rates, coupled with tax deductions, many investment properties are now approaching a cash-flow-neutral or even cash-flow-positive status in ‘Key’ suburbs of Melbourne.

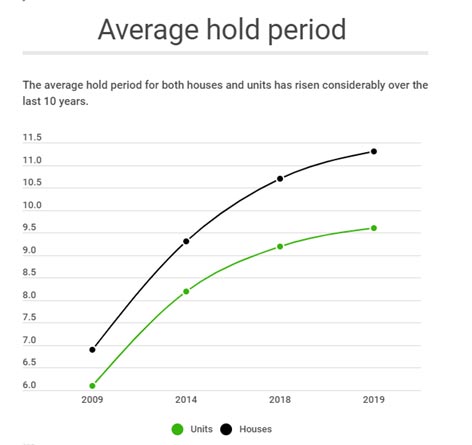

Plus, what no one is really talking about in the media is that Australians are holding onto their homes for twice as long as they were 10 years ago! In some suburbs the average owner is holding their house for up to 17 and even 20 years before they end up selling.

50% of loans in 2021 were for the purpose of investing; this is likely to increase in 2022 as many investors have benefitted from the high capital growth of their investment properties, especially those holding blue-chip stocks in Melbourne and Sydney. Investors will no doubt use their new equity as a way to buy more investment properties.

But I bet you haven’t seen the media blasting these points as front-page headlines! Why?

For starters... it’s not negative or newsworthy enough, right? They want to sell more papers, so it’s pretty much jammed-packed with fear-based, SHOCKING news.

You know what I mean.

In-fact, here are some of Australia’s top suburbs where Australians are refusing to sell their homes and are holding them for longer and longer, further reducing the supply in the market place.

And here is one of the most exciting pieces of information that every Australian aspiring property investor should know about…

A recent study by Aussie Home Loans revealed that Australia is on the brink of one of the biggest property bull-runs of the century!

That’s right… a bombshell study has revealed;

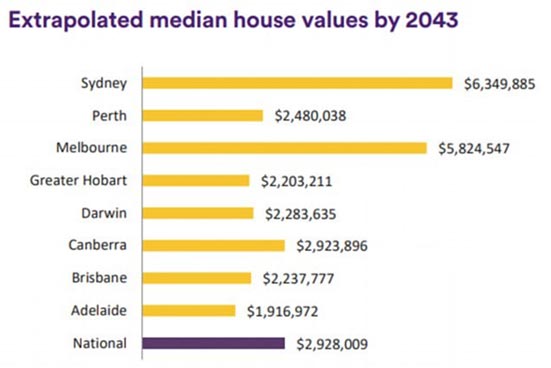

Projections show median house prices will reach that figure ($6.3 Million) in Sydney by 2043 - up from $1.03 million today.

The Aussie Home Loans and CoreLogic survey predicts average prices will hit $5.8 million in Melbourne, $2.9 million in Canberra, $2.5 million in Perth and $2.3 million in Brisbane - with the biggest increase in Melbourne.

If you feel that you are ready to start building a property portfolio, or you have been wanting to buy an investment property for a long time, but you have been paralysed by ‘too much information’ and weren’t quite sure where to start, or you are simply too time poor, then you need to seriously consider booking yourself and your partner in the ‘4 Day Property Portfolio Accelerator Summit 2022’.

Here is my advice to you…

All I ask is that you have an open mind, and take plenty of notes, as the 4 Day event will be filled with tons of the latest up-to-date property investing advice delivered by some of the most qualified forward-thinkers in the industry today.

Final thoughts…

One thing that I must stress is that this is NOT a get-rich-quick scheme, and I guarantee that you will NOT become a millionaire overnight by following this system.

This is a get-rich-very-slowly over a decade system, by following and implementing a proven strict plan of action, that has been around for decades!

So, if you are someone that wants to get rich-quick, then don’t waste you time or money and forget about attending this event…stick to Crypto-Currency, NFT’s, or selling a JPEG image of a Bored Ape for $2,500,000!

I am not going to insult your intelligence or make unrealistic claims, and neither will the speakers speaking at this event.

But, if you are someone who is ready to learn the 'secret recipe' of how to build, structure, and automate, a multi-million dollar property portfolio that will enable you to create financial independence and the lifestyle that you and your family truly deserve, then do yourself a favour and secure your seat at the ‘4 Day Property Portfolio Accelerator Summit 2022’, NOW!

During the ‘4 Day Property Portfolio Accelerator Summit 2022’ you will discover advanced Australian property investing strategies and learn specific real estate finance and property due-diligence methodology, that will give you the confidence and skills to start building your property portfolio as soon as you finish the event!

You will learn how to set up your loans correctly, asset protection structures, and identify the very best areas for growth properties in Australia that will enable you to accelerate your ability to build a multi-million dollar property portfolio in your spare time.

The ‘4 Day Property Portfolio Accelerator Summit 2022’ reveals the 'secret recipe' of how to correctly structure your finances with the objective of maximising leverage and tax efficiency, whilst focusing on buying more investment properties and simultaneously paying off your home loan in record time, saving you tens of thousands of dollars in unnecessary interest payments over the life of the loan!

I guarantee you that this one section is worth attending or watching the entire event!

Plus…

You will gain insights on how to understand property cycles, state by state, and exactly how to hone in, with precision, on Melbourne's hot spots in 2022 and beyond.

You will learn how to conduct a cash-flow analysis in order to compare the advantages and disadvantages of different types of investment properties, i.e., house and land, townhouses or apartments.

You will learn how to identify, assemble, and leverage, the very best property consultants and property industry experts that will take years off your learning curve, and enable you to grow your portfolio in the most efficient way possible.

And as a result, by attending the ‘4 Day Property Portfolio Accelerator Summit 2022’ you will boost your financial literacy and intelligence, and take your property investing to a whole new level!

Looking forward to meeting you during the 4-day summit!

To your success,

P.S. This is possibly the best (and smartest) way for you to quickly take advantage of Australia’s property investing market and discover everything you need to know to grow a successful property portfolio fast!

P.P.S. You’ll get THOUSANDS of dollars of REAL-WORLD value and experience over this life -changing 4 day event, – learning from some of Australia’s elite educators! Be sure to click the button and reserve your spot today!

P.P.P.S. Remember… if you are interested in attending the live version of this event, SPOTS ARE LIMITED TO 250 Investors ONLY! This is strictly on a first-in-first-served basis, so book your place now to avoid missing out.

Interested in learning more about property investing in Australia? Please visit our main website InvestorsPrime.com.au for loads of free resources, articles, videos and more to help you on your investing journey.